Importance of Auditing in a Financial Services Firm

Financial services firms must conduct regular audits to assure customers and industry regulators that they are complying with the law and best industry practices. These routine, internal reviews of the records, operations, and internal controls check that all systems are performing properly, while increasing transparency, efficiency, and customer security. These audits can be performed by hiring an outside accounting firm, or internally by an in-house audit team.

HighGear believes that an internal audit program is an essential function in any information security and compliance system. We recommend that financial services firms implement an internal system for audit management to assure records and processes stay in compliance and to monitor in-house auditing activities. Keeping these activities running like clockwork assures that financial reports remain reliable, helps prevent fraud and misappropriation of assets, and minimizes the cost of capital, all while assessing the risk of material misstatement in a company’s financial reports.

Workflow Software

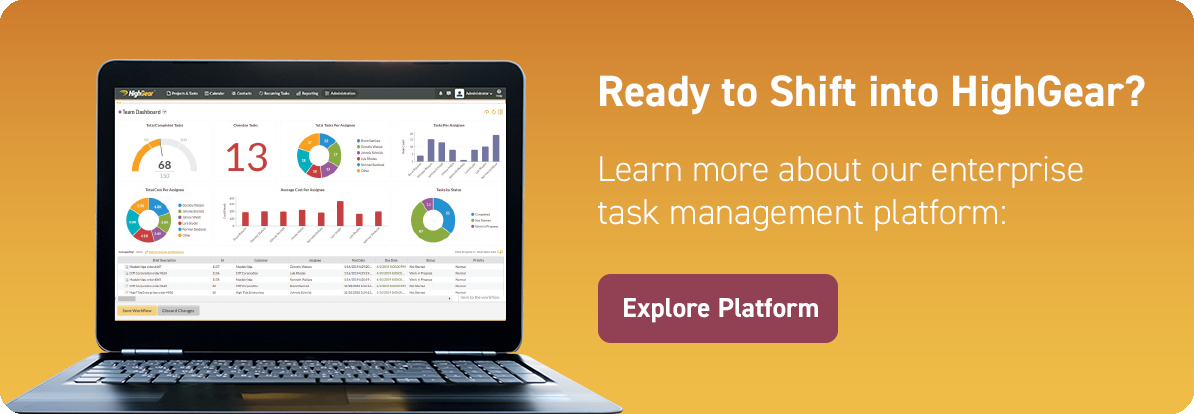

Workflow management software is a boon for any entity that could benefit from a robust, internal auditing system. In general, workflow management software channels the flow of an auditing team’s progress, directing its course from start to finish. A solid workflow tool serves as a guide for the flood of tasks that need to happen along the way, with outcomes and artifacts becoming fully formed as they flow through different processes, checks, and balances. It eliminates the need for assigning tasks, managing work, and tracking progress with paper, e-mail, spreadsheets, or, worse, post-it notes! It allows anyone to see exactly what the status of any task or assignment is, keeps work from falling through the cracks, and ensures visibility into the tasks.

HighGear’s No-Code Workflow Application Platform is a “turn-key” system that does not require any programming or coding. What this means is that your already beleaguered IT department will not be called upon by vexed colleagues needing patches or coding updates. Instead, our platform will free up your IT department to do its work without getting involved with intra-departmental communication issues and artificial, avoidable work-flow bottlenecks. We will empower your business analysts to drive digital transformation through our intuitive, drag-and-drop platform, without hiring or derailing existing programmers, developing homegrown IT solutions, or adapting to low-code software.

At HighGear, we emphasize that our platform allows autonomy, agility, and auditing. In order to meet heavy audit pressures and regulations, incredibly high standards must be ensured for any business process. This includes always on practices like permanent, unchangeable audit trails and detailed transaction histories. Technical teams and compliance experts must do a lot of work to define their policies and implement procedures to enforce those policies. But they often overlook the effort required to track activity and prove compliance, which makes the auditor’s visit one of the most dreaded and painful experiences of the year.

Pain Points and Challenges to Internal Auditing

Workflow Silo

When trying to adapt to today’s rapidly changing business environment, the thorn in a financial services firm’s side is having “siloed” workflows. Organizational silos refer to departments within a company that operate independently from one another and are often unable or unwilling to share information. Silos make it hard or impossible to enable information sharing across functional areas. When a new demand arises that regularly requires one department to get information from another, things can break down. This is especially true of auditing. Whether communication is hampered because of mismatched software, a culture of competitiveness, or outdated SOPs, by getting everyone on the same page, so to speak, HighGear’s platform will streamline the auditing process and provide iron-clad proof that it was followed.

Legacy Systems

Information technology and computing systems have been evolving at a breakneck speed. No one can afford to update their software and/or computers every time there is a newer version available. Users also become attached to the systems they use leading to a better-the-devil-you-know mentality. These systems, although still functional, eventually become outdated when compared to new systems, hence the term “legacy” systems. Different departments update their software and/or computers at different times and voilà, one of the major ingredients of workflow siloes is created. HighGear’s platform is immune to these mismatched legacy systems because it is independent of them. HighGear’s platform is immune to these mismatched legacy systems because it is independent of them and can tackle legacy issues in 2 major ways. Firstly, HighGear becomes the unified UI and platform integrating with legacy and non-legacy systems and applications across the business. Secondly, the platform can use and share extracted data. Ultimately, our workflow solution allows for either cost-effective replication of legacy systems or it acts as a protective and transformative layer above them.

Make it IT’s Problem

A non-homogenous tech environment tends to become the IT department’s problem. They get involved with writing patches or installing short-term fixes. This of course exacerbates the problem in the long run. Or they attempt what we call a Big Bang approach, blowing up the system and starting from scratch. In a way, they are trying to create what HighGear is offering, a comprehensive data sharing system to improve workflow and communication. Unfortunately, most of these efforts end in disaster. No matter how well-intentioned and experienced the IT department is, trying to reform a system from within is very difficult if not impossible. HighGear’s no-code platform has been rigorously tested, vetted, and validated. This last point is very important when considering the extraordinary demands placed on financial services firms for accuracy and transparency in their auditing efforts.

Remote Access Breeds Temptation

According to Forrester Research Inc., pandemic-related uncertainty, remote work conditions, and employee experience are colliding to create the ideal conditions for insider incidents. They estimate that one-third of security breaches will be caused by insider threats in the coming year. With HighGear’s platform, analysis of a company’s operations and maintenance of internal controls can help internal auditors prevent and detect various forms of fraud and other accounting irregularities. An important part of fraud prevention can be deterrence. If a company is known to have an active, diligent, and highly visible internal audit system in place, by reputation alone it may prevent an employee or vendor from attempting a scheme to defraud the company.

The Three Lines of Defense for Risk Management

Best practices are emerging that can help financial services firms tackle risk management with a systematic approach. The Three Lines of Defense model clarifies essential roles and duties and provides a simple, effective tool for enhancing communications on risk management and control. HighGear’s platform is specifically designed with this model in mind. The Institute of Internal Auditors strongly believes in this model which is excerpted below:

The First Line of Defense is Operational Management which is responsible for maintaining effective internal controls and for executing risk and control procedures on a day-to-day basis.

The Second Line of Defense, Risk Management and Compliance, is the structure for implementing and monitoring the First Line. Multiple compliance functions are often found in a company with responsibility for specific types of compliance monitoring, such as health and safety, supply chain, environmental, or quality monitoring.

The Third Line of Defense, drumroll please… The Internal Audit! Establishing a professional internal audit activity should be a governance requirement for all organizations. Internal audits provide assurance on the effectiveness of governance, risk management, quality and other internal controls, including the manner in which the first and second lines of defense achieve risk management and control objectives.

Workflow Platform Examples of Auditing and Compliance (Case Studies)

Swift Systems, a data center operator and managed services provider, had built a robust set of compliance policies and controls originally based on the NIST 800-53 standards. Over time, extra elements were added to address additional standards and protocols such as DIACAP, PCI, and HIPAA. To verify that those extensive operational and security controls were properly implemented, an outside auditor conducted annual SSAE-16 Type II audits. After switching to HighGear’s platform, Swift Systems passed their next audit with flying colors. In fact, the auditors remarked about how impressed they were with HighGear’s functionality and reporting capabilities. They were able to identify and examine all change control requests for the past 12 months, easily searching for that information and quickly exporting it to an auditor-satisfying PDF.

Demand Manager is an Australian company that helps companies secure financing for clean energy upgrades, like solar power, and navigate the markets for environmental certificates. Like any financial services firm, audits are an inescapable part of their industry. However, that was not the driving force to begin using the HighGear platform. They wanted to streamline their operations by consolidating project management so they could efficiently handle a larger volume of projects, i.e. more revenue! What a pleasant surprise, then, to realize that streamlined operations included the ten to twelve audits they endured annually. These audits not only cost around $30,000 each, but disrupted the office as auditors manually went through paperwork. Auditors can now login from their own office and complete 99% of their work without ever visiting Demand Manager’s offices. This allows staff to stay focused on their work and has saved about $15,000 per audit. In other words, HighGear helped company employees continue generating income while also saving the company up to $180,000 in hard costs annually.

Conclusion

HighGear’s No-Code Workflow Application Platform is a win-win for your company’s bottom line. With the agility and autonomy built in to our workflow system, your employees can get more work done in less time. By flattening siloes, by-passing legacy systems, and liberating the IT department from patching non-homogeneous systems, projects are trackable, changeable, and never orphaned. However, an often undervalued function of this transparency and searchability is the power of a streamlined audit. Ensuring regulatory compliance and safety against employee “extravagance” are the tangible benefits. Your staff’s peace of mind is a benefit that does not show up, directly, on any financial spreadsheet.

One of our customers likened using HighGear’s platform to the experience of taking the car to the inspection station. What was once a dreaded, capricious task, became a no-brainer after they had purchased a luxury automobile with an on-board computer. Rather than the usual arduous procedure of physically checking the car’s systems, such as emissions, the technician simply plugs in a cable and downloads the data. With the ease of acquiring the data, along with the reputation of the auto manufacturer, regulators could allow inspection staff, auditors if you will, to trust whether a car is in compliance.

HighGear’s reputation and potent audit tools will save your company time, money, and anxiety. No longer will you dread the proverbial page to “report to Conference Room A!”