Scaling U.S. Insurance Underwriting Operations

Founded in 1986, Beazley is a global specialist insurer with an unbroken 34-year record of profitability, underwriting $3 billion of gross premiums annually, with over 1,000 employees, across five continents. The company has been underwriting U.S. risks since its formation three decades ago and opened its first U.S. office in Farmington, Connecticut in 2004 to underwrite professional and management liability insurance. Beazley now provides insurance products rated A (Excellent) by A.M. Best across six divisions, including cyber and executive risk, marine, property, reinsurance, specialty lines, as well as political, accident and contingency.

Founded in 1986, Beazley is a global specialist insurer with an unbroken 34-year record of profitability, underwriting $3 billion of gross premiums annually, with over 1,000 employees, across five continents. The company has been underwriting U.S. risks since its formation three decades ago and opened its first U.S. office in Farmington, Connecticut in 2004 to underwrite professional and management liability insurance. Beazley now provides insurance products rated A (Excellent) by A.M. Best across six divisions, including cyber and executive risk, marine, property, reinsurance, specialty lines, as well as political, accident and contingency.

The Workflow Challenge

After evaluating underwriting platform providers, Beazley’s IT department decided to build an internal solution to meet its core underwriting needs. IT’s U.S. product configuration team was responsible for integrating best-of-breed tools into its system architecture to provide the insurance rating engine, document generation, business rules and workflow capabilities. In order to manage thousands of policy generation tasks between its core underwriting platform, third-party systems and line of business users, the team began researching workflow automation solutions that could help Beazley scale the volume of U.S. insurance underwriting operations.

The HighGear Solution

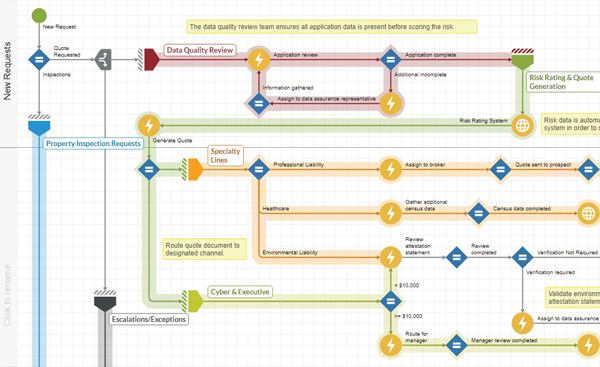

HighGear’s no-code workflow automation platform allowed Beazley to focus its development resources on improving internal underwriting processes, instead of building workflow and task management functionality from scratch. Visual workflow tools simplified the design of custom processes for seven teams, before standardizing and centralizing U.S. underwriting operations. Enterprise task management continuously assigned thousands of tasks to shared work queues for completion by the underwriting operations team. Real-time reporting and metrics provided visibility into the status of tasks and SLA’s across its team of underwriting, claims and IT professionals.

See how easy it is to build a custom task management application in 60 minutes or less.

The Results of Automation

HighGear’s workflow automation platform now manages the flow of work between Beazley’s core underwriting platform, third-party systems and unique processes for its teams and line-of-business users. HighGear has helped Beazley achieve faster time to market, reduce the cost of delivering insurance underwriting products, increase capacity and improve the productivity of U.S. underwriting operations by 30 percent. HighGear allowed Beazley to design, develop, and deploy new workflows independent of its underwriting platform, enabling the company to process 45% more risks year-over-year within the first 12 months of deployment.

“Our high-volume teams saw an immediate 30% improvement in productivity after the original rollout. Another business team used to measure their turnaround time for quotes in days. Now that we are using HighGear, their turnaround time is measured in minutes.”

Technical Architect

A trillion-dollar investment management firm migrated global fund operations into HighGear by consolidating three fund services business lines into a single shared services team.

“HighGear gave us the ability to scale. In the U.S., there’s no way we would have been able to scale the way we have, without HighGear in place.”

Technical Architect

Results

- Processed 45% more risks year-over-year within the first 12 months

- Generated efficiency gains of 30%, reducing time from months to weeks

- Shortened turnaround time for policy generation from days to minutes

- Provided real-time visibility for

- U.S. underwriting operations team

- Reduced time-to-market and the cost of delivery for underwriting products

Solution

- System Integration APIs

- Workflow Automation

- Task Management

- Assigned Work Queues

- Real-Time Reporting

- Easy Onboarding

- Rapid Deployment

Easily Create Forms, Design Processes and Automate Workflows

Shift into HighGear and start building your workflows the easy way.