Case Studies

Ensuring Financial Regulatory Compliance with No-Code Workflow Automation

Formed in 1991, cfX Incorporated is dedicated to helping state Housing Finance Agencies (HFAs) develop and maintain outstanding affordable housing programs, manage cash flow and analyze portfolio risks. Due to its role in advising HFAs on complex financial products and transactions, cfX is regulated by both the Securities Exchange Commission (SEC) and Municipal Securities Rulemaking Board (MSRB). Regulatory compliance is crucial to the success of cfX’s clientele in managing billions of dollars that directly impact taxpayers, investors and hundreds of thousands of families relying on HFA support to achieve their American Dream.

Formed in 1991, cfX Incorporated is dedicated to helping state Housing Finance Agencies (HFAs) develop and maintain outstanding affordable housing programs, manage cash flow and analyze portfolio risks. Due to its role in advising HFAs on complex financial products and transactions, cfX is regulated by both the Securities Exchange Commission (SEC) and Municipal Securities Rulemaking Board (MSRB). Regulatory compliance is crucial to the success of cfX’s clientele in managing billions of dollars that directly impact taxpayers, investors and hundreds of thousands of families relying on HFA support to achieve their American Dream.

The Workflow Challenge

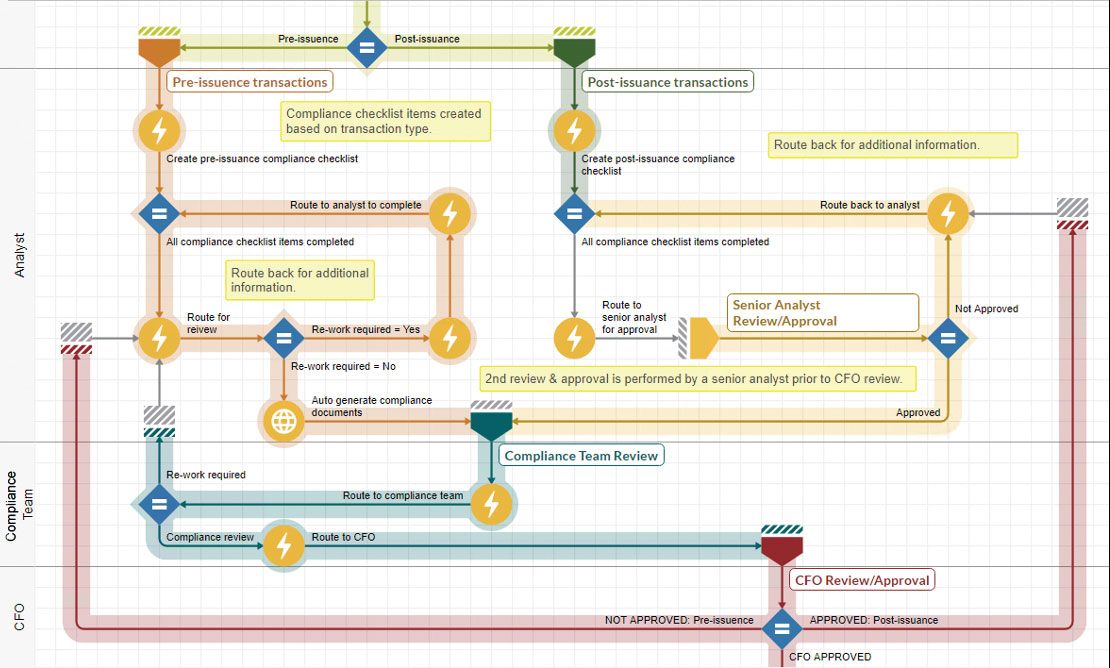

In order to streamline SEC and MSRB regulatory compliance, cfX sought to standardize its process for providing advisory services, financial recommendations and operational assistance to HFAs nationwide. This included managing operations for the sale of municipal bond securities, satisfying rating agency requirements and advising clients on expected IRS tax implications for bond structures and transaction timing. For example, cfX’s team of specialists needed to complete a series of complex operational requirements and regulatory compliance deadlines for municipal bond sale fundraising programs for its clients and investors.

The HighGear Solution

cfX implemented HighGear’s no-code workflow automation platform as part of its SEC compliance framework for recommendation review, sign-off and validation. Visual workflow tools allowed cfX to continuously modify and refine compliance workflows to meet customer and regulator requirements. Enterprise task management automatically prioritized and assigned tasks to multiple team members, managed deliverables and scheduled due date notifications. Real-time reports provided visibility into the status of activity across the organization to ensure compliance requirements and deadlines were met for clients and investors.

The Results of Automation

HighGear allowed cfX to demonstrate compliance with SEC and MSRB regulations by establishing policies and procedures for managing the recommendation process, without any tasks falling through the cracks. By automatically enforcing complex compliance requirements, HighGear also enabled lower-level staff to perform higher-level work, while saving senior managers enough time to focus on improving how work gets done. HighGear ensured cfX advisors provided financial advice that met the exacting standards of outside regulators, while quickly demonstrating its ability to fulfill duties and obligations to both clients and regulators.

Testimonial

“We needed a technology platform that allowed us to scrutinize work at any stage, while reinforcing compliance behaviors and patterns as work is being carried out. HighGear was fully customizable to our needs.”

Chief Compliance Officer

Solution

- Workflow Automation

- Task Management

- Assigned Work Queues

- Team Collaboration Tools

- Real-Time Reporting

- Regulatory Compliance

- Non-Repudiable Audit Trail

Results

- Standardized the advisory process for selling municipal bond securities

- Refined compliance workflows to meet regulatory requirements

- Prioritized and assigned compliance tasks across multiple team members

- Provided real-time visibility into all regulatory compliance activities

- Demonstrated HFA compliance with SEC and MSRB regulations

“HighGear allowed us to automate. Our customers appreciate that compliance is now baked-in as an integrated part of how cfX delivers services.

“Before, 75% of our work was simply not visible, but after deploying HighGear, we see tasks and deadlines across the entire organization.”

Principal Consultant